Tashota Resources Inc. (“TRI” or the “Company”) is pleased to provide an update on recent activities:

HEMLO

The Hemlo camp has now taken on a life of its own due to the accelerated exploration and development activities of Barrick Gold Corporation (“Barrick”) on their Hemlo properties in 2016. A surge of property acquisitions and staking has taken place by junior companies such as Canadian Orebodies Inc. (TSE-V: CORE) and, more recently, Golden Peak Minerals Inc. (TSE-V: GP).

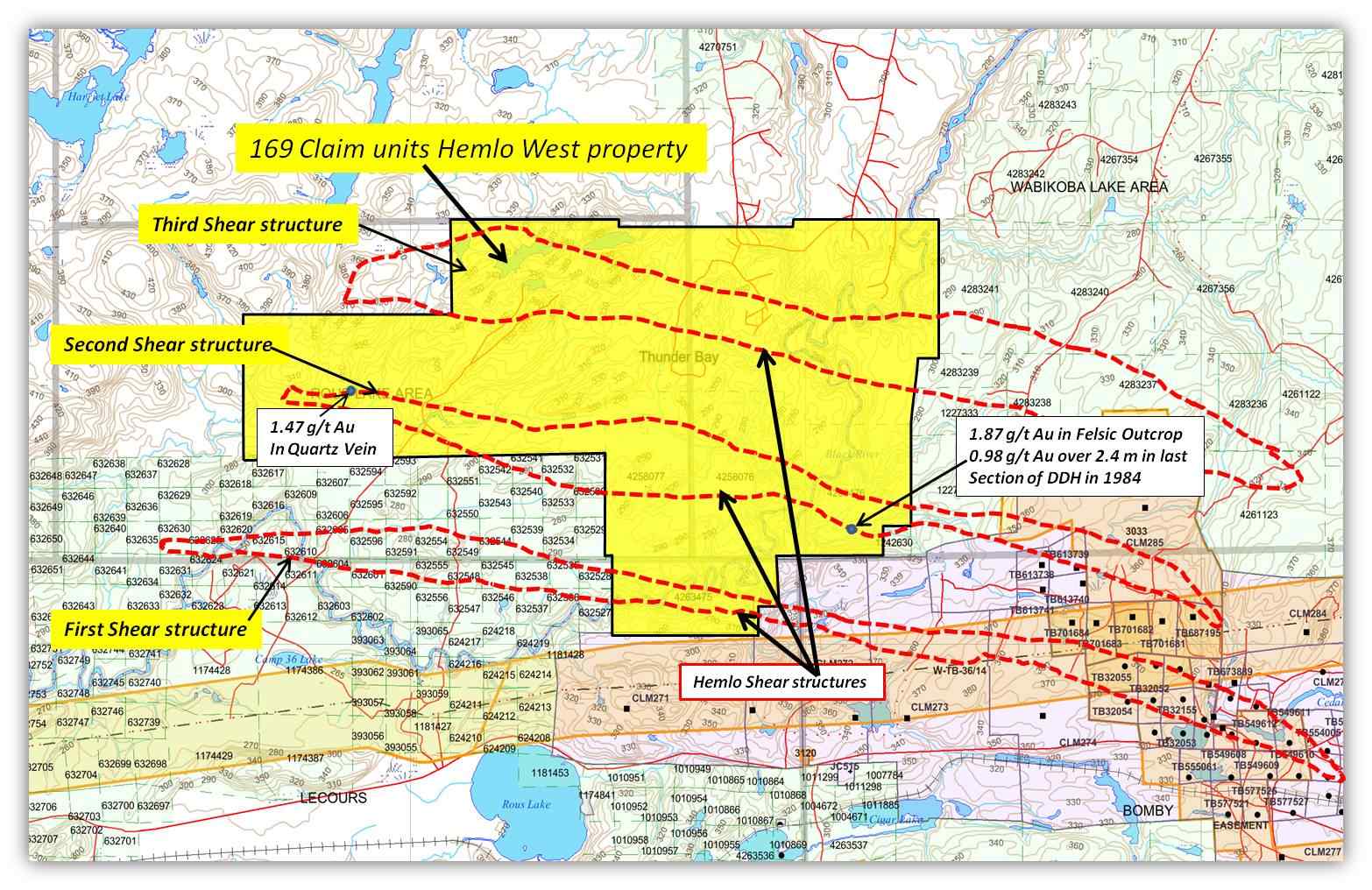

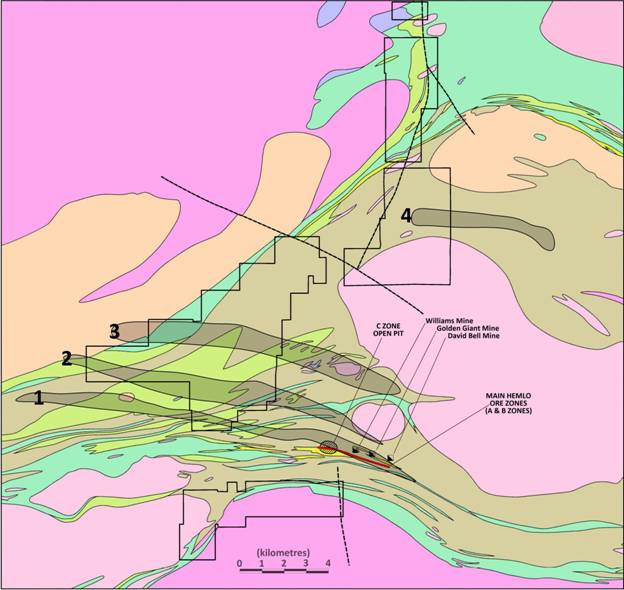

TRI’s Hemlo West and Black River claims are situated approximately 2.9 kilometres west of the Barrick’s open pit and Hemlo North approximately 7.6 kilometres north of the pit. Hemlo South is situated approximately 1,000 metres from Barrick’s Williams Mine and open pit, with drilling operations scheduled to commence here during the next few months by TRI/TGI.

TRI had optioned Hemlo South in 2014, Hemlo West and North in 2015, and Hemlo Pinegrove in 2016 - acquiring a first mover advantage, and believe the Company has amassed a superior property position next to Barrick’s main western expansion and potential new discovery based on their recent announcements.

What started the initial resurgence in the Hemlo camp was Barrick’s drilling activity during the fall of 2015 that carried over into and throughout 2016, growing reserves at Hemlo by 0.9Moz of gold and Inferred resources by 1.3Moz of gold. Barrick has also outlined major plans for mine expansion during 2017. Note: (www.barrick.com) and refer to the Webcast section titled “Operations and Technical Update” February 22, 2017 – Presentation (PDF) and refer to slide # 33.

Slide # 33 illustrates three (3) main points regarding expansion at Hemlo:

- The Game Changer: Doubled property footprint, removing mining and tailings storage constraints

- The Enabler: 2016 Comprehensive Hemlo Geological Compilation Study

- The Future: Mineralized target potential Go west, go deep, automate

Note: Go west is potentially of great significance for TRI as TRI’s Hemlo West property is situated to the west north-west of Barrick’s Williams Mine open pit.

On YouTube (https://www.youtube.com/watch?v=a-upee1oOY0) Barrick has provided an excellent video rendition of development plans to the immediate west of the Williams open pit including at depth drilling.

Note: On TRI’s website refer to the Hemlo West Shear Structure Map which outlines three interpreted shear zones as previously suggested by Kaminak Gold Corporation (“Kaminak”) and consultant GeoVector:

Kaminak had staked the area in 2007 and, after their first season’s field work, indicated in a press release: “Examination of publicly available geological reports and digital geophysical databases by Kaminak and consultant GeoVector Management Inc. strongly indicate the Hemlo deposits are related to a west-northwest trending shear zone. Further evidence suggests the presence of stacked or parallel shear zones north of this main ore trend. Kaminak's technical team believes that there has been a lack of exploration directed towards shear zones models at Hemlo, thereby creating a new exploration opportunity in this district.”

TRI acquired the area in August 2015 when Kaminak allowed their claims to lapse due to their concentration on their Coffee Project in the Yukon, which they subsequently developed and were acquired by Goldcorp in 2016 for approximately $520,000,000.

TRI management completed an airborne TDEM survey on the Hemlo West and North properties during 2016 and the results further suggest the presence of three (3) shear structures crossing the Hemlo West claims as previously interpreted by Kaminak consultant GeoVector, and a fourth (4) shear zone on the Hemlo North property.

When the Hemlo gold deposit, that has produced 22 million ounces of gold to date, was first discovered and developed in the early 1980s, it was widely thought to have a syngenetic origin. “Syngenetic” refers to ore deposits that were formed at the same time as the rocks in which they occur.

By contrast, the great majority of gold deposits in Canada are “epigenetic”, meaning that the gold was introduced into its host rocks after the rocks were formed, usually into shear zones and fractures that allowed hydrothermal solutions to permeate the rocks. The syngenetic model dominated exploration in the Hemlo area through the 1980s and early 1990s when most of the recorded exploration took place. It had become apparent by the year 2000 and after several detailed studies of the Hemlo gold deposit, that the gold mineralization most likely has an epigenetic origin and was probably controlled by a structure called the Lake Superior Shear Zone.

With its change in direction from west-northwest to due west, the Lake Superier Shear Zone at its western end was delineated by the Lake Superior Mining Corporation in the late 1940s.

Once a feature like that gets on government geology maps, it tends to be regarded as an established fact rather than a hypothesis based on inference. Structural geology principles suggest that the due west trend may be what is called a “second order shear” branching off the main shear, that should continue in a west-northwest direction. Kaminak and GeoVector’s shear zone theory is much more consistent with the epigenetic than with the syngenetic model.

The ongoing development and discovery activity by Barrick to the west and north-west suggests the above mentioned shear zones could be of importance in continuing to find new resources, once again providing Barrick with a main core asset at Hemlo.

TRI is well positioned to participate in this future growth at Hemlo.

LAROSE

Situated 110 kilometres west of Thunder Bay, the Shebandowan West Gold Camp has now become a favourite area for exploration.

TRI’s Larose property includes the Larose Shear Zone (LSZ) that runs approximately 9 kilometres and probably another 4-5 kilometres through the Echo Ridge property which is 50% joint ventured with TRI. The combined properties cover approximately 11,000+ acres (including the Larose and Echo Ridge).

As previously stated, there is a renewed interest in the area with Wesdome Mines (3,000,000+ ounce gold Moss Lake deposit) expanding their land position and acquiring Canoe Mining, which includes the North Coldstream Mine property, and with Kesselrun Resources Ltd acquiring the Ardeen Mine property from Pele Mountain. The Ardeen Mine property adjoins the Larose property. Recently, White Metal Resources Corp. (WHM) optioned the Benton Resources property to the east of Larose. Interestingly, WHM is of the opinion that there is a good opportunity to find cobalt in the Shebandowan camp. In their December 16, 2016 press release, WHM stated; “From compilation and research work that has been completed to date, White Metal believes there is not only potential to uncover additional resources but also cobalt potential. From a review of data from the Coldstream mine it is believed the mine deposit hosted significant cobalt credits that were discarded in the tailings. Sampling of the mine core by the Ontario Geological Survey (Lavigne, M. and Scott, J. 1989-1992 Ontario Geological Survey, Resident Geologist) indicated assay results of up to 0.36% cobalt. A review of historic drilling on the East Vanguard property completed by Oval Bay Consulting in 1997, indicated assays grading up to 0.156% cobalt.”

Trojan Gold Inc. (“TGI”) a company associated with TRI (see additional information below) has staked approximately 12,000+ acres adjacent to WHM and is situated within, approximately 1,300 metres to the north of the old North Coldstream Mine. While concentrating on gold, TGI will also be exploring for cobalt, a metal used in lithium-ion batteries (such as those used in Tesla automobiles) and with increasingly positive supply and demand fundamentals.

During the fall of 2016 at Larose, TRI completed a TDEM airborne survey by Prospectair of approximately 790 line-kilometres. The airborne delineated new drill targets and areas of interest for subsequent field work, including channel sampling.

TRI controls one of the larger land positions in the Shebandowan area and the immediate target for exploration drilling in 2016 was primarily at the P1 and Larose Trench.

In order to prepare for the 2017 drilling season, TRI improved over 26 kilometres of roads (previously used for forestry) covering over 9 km access of the shear from the CB trench to the T trench.

Grab samples, taken by the Ministry of Northern Development and Mines Geologists (received January 2017) on Larose property, produced some excellent hi-grade gold samples, including samples primarily from the P1 Trench:

P1 1.76 oz/ton

P1 1.63 oz/ton

P2 2.36 oz/ton (new trenching 2016)

P1 West 5.058 oz/ton

Samples taken in fall of 2016 from the Larose Trench area, included:

0.88 oz/ton, 0.83 oz/ton, 0.92 oz/ton, 1.15 oz/ton, 1.75 oz/ton, 0.74 oz/ton, 1.57 oz/ton, and 0.55 oz/ton

To the east of the P1 Trench (approximately 3.35 kilometres), sampling (taken by Ministry Geologists) at the T Trench continued to achieve good grades, including 1.786 oz/ton with consistent sampling above .016 oz/ton. Previous sampling at the T Trench by Freewest Resources included grab samples as high as 151 gm/ton (5.1 oz/ton)

As previously mentioned, drilling during Fall 2016 produced interesting results, given these were shallow exploratory drill holes. The first drill hole intersected an “unexpected” high grade gold bearing zone including 5.65 grams of gold per tonne (g/T Au) over 3.00 metres from 42.00 to 45.00 metres downholeand 0.50 metres of 27.69 g/t Au. If adjacent samples with lower gold contents are included, a section from 38.50 to 46.00 metres, averaged 2.84 g/t Au over 7.50 metres.

DDH#2 and DDH#3 intersected 0.55 m @ 21.6 g/t and 0.55 m @ 37.34 g/t. DD#4 and DDH#5 failed to show a continuation of the particular trend which indicated “that the high grade section probably trended steeply down rather than plunging at a shallow angle to the southwest as had been assumed by the Freewest exploration team”. The steeply plunging trend had been previously proposed by Prof. Mary Louise Hill of Lakehead U, one of TRI’s technical advisors, on the basis of her examination of the trenches.

New drill targets at Larose have been delineated from the T-DEM airborne survey conducted in the fall as having areas of interest that require subsequent field work to be continued spring 2017, in advance of further drilling.

OPINACA

Situated in James Bay, Quebec, this area has drawn the attention of investment institutions since Goldcorp Inc. (“Goldcorp”) acquired the Éléonore gold mine (now approximately 9 million ounces of gold in Reserves) from Virginia Mines. TRI acquired a 50% interest in approximately 18,600 acres from Trincan Capital in 2014 and is presently in negotiations to acquire a 100% interest in 4,500 acres situated in the center of the 18,600 acres, through association with TGI. An airborne T-DEM over 1,400 kilometres was conducted by Prospectair in 2012 which indicated potential good drill targets for winter drilling scheduled to commence in 2017.

The property is surrounded by Virginia Mines (now Osisko Mining Corp) and Goldcorp and many juniors active in the area are located to the east, including Sirios Resources Inc. (TSE-V: SOI), Eastmain Resources Inc. (TSE: ER), and Beaufield Resources Inc. (TSE-V: BFD). There is major exploration and development taking place in the Opinaca area of James Bay region.

From TRI’s perspective, the most important development in the area is the discovery of high grade gold in tonalite on the Cheechoo property of Sirios Resources Inc., 27 km east of Opinaca. Tonalite, which is a variety of granite, is the same rock type that underlies the Opinaca property - this validates the exploration model that TRI relied on when deciding to acquire Opinaca.

TROJAN GOLD

TRI will be acquiring an investment position in Trojan Gold Inc (“TGI”), presently a private company, by converting approximately $200,000 in a P/Note for 4,000,000 common shares in TGI, at a price of $0.05 per common share, as a result of advances previously made to TGI.

TGI has executed a letter of intent with ChiChi Financial Inc., an unlisted reporting issuer in Alberta and B.C., to conduct a reverse takeover with the goal of seeking a listing for TGI on the Canadian Securities Exchange. There can be no assurances that the transaction will be completed or that a listing on the Canadian Securities Exchange will be granted and TGI cannot guarantee a timeframe for such events.

Technical information in this document has been provided and/or reviewed by Colin Bowdidge, Ph.D., P.Geo., a Qualified Person as such term is defined in National Instrument 43-101. Assays quoted in this document, where they refer to diamond drill holes on the Larose property, were performed by Accurassay Laboratories Ltd. in Thunder Bay, Ontario using fire assay preparation on 30-gram splits of pulverized material, followed by atomic absorption analysis. Accurassay is a Canadian-owned and operated laboratory with certification under ISO/IEC 17025 for assays of gold, platinum, palladium, copper, nickel and cobalt. Core samples were cut using a diamond saw under the supervision of Dr. Bowdidge. Assays quoted for grab samples taken by personnel of the Ministry of Northern Development and Mines were performed by the Geoscience Laboratory ("Geo Lab") of the Ministry in Sudbury, Ontario using the same fire assay protocol. The Geo Lab has ISO 9001 certification and has Accreditation No. A2927 from the Canadian Association for Laboratory Accreditation. Grab samples are taken to assess the general range of composition of a particular zone or style of mineralization. As such, grab samples should not be considered representative of any zone, or any width, length or volume within a zone. Tashota Resources Inc. does not accept responsibility for statements made in print by Barrick Gold Inc.

FINANCING

Management is presently completing a financing of Units consisting of treasury ($0.10) and flow-through shares ($0.15), due to close March 31, 2017. A flow-through offering at ($0.20) is expected to commence April 1, 2017, proceeds of which will be used to advance drilling on the Hemlo and Larose properties. Present and future offerings are available to shareholders and the public; presently restricted to “accredited investors” only.